Six Drivers to Successful Capex Sourcing

Capitalize on the Six Drivers of Successful CAPEX Savings Strategies

Executive Summary

Enterprise procurement organizations are in a uniquely advantageous position, due to their enterprise-wide responsibilities, to better manage capital expenditure (CAPEX) purchasing.

Valuable techniques, such as consolidating spend across projects with multi-year / multi-project contracts, facilitating joint specification improvement and fleet-wide asset management, can reduce one-time and TCO costs dramatically, saving 25 percent or more than typical one-off purchases.

But to optimize potential savings, enterprise procurement teams can and should develop six specific capabilities focused on building process consistency across business units, integrating spend and supply market knowledge into procurement decisions, and managing suppliers.

CAPEX Purchasing – Traditional Paradigm

In a traditional project manager–procurement manager relationship, the project manager is part of the business unit or plant organization and the procurement professional is part of a centralized, shared service.

The project manager works with plant production, maintenance and engineering to define the scope of outside resources needed for the project. These decisions are usually based on the availability of plant resources for the project and some loose criteria about what is done in-house versus what is done on contract. The plant team, led by the project manager, creates the initial scope and, in some cases, the plant team may also list the suppliers that they will approve.

The project manager develops the technical specifications, which are tailored to the way the plant prefers to work. In effect, the technical specifications establish de facto business processes, addressing items such as shop drawing reviews, schedule coordination, acceptance procedures, and contractor reporting.

The project manager communicates all of this to procurement and the procurement team proceeds to contract as directed.

The aim here is shortening cycle-time. Good procurement performance, in the eyes of the project, business unit and plant managers means quickly implementing contracts that meet business unit requirements.

This approach fails to involve procurement until after key decisions are made, relegating the procurement team to a well-defined solicitation process that culminates in tough, structured negotiations.

Valuable techniques such as consolidating spend, multi-year contracts, joint specification improvement, fleet-wide asset management, performance-based logistics, and others simply cannot be accommodated in this approach.

CAPEX Purchasing – Enterprise View

What happens when procurement manages CAPEX purchases across the enterprise?

To be sure, reducing cycle-time is still important and strong negotiating skills continue to produce better contracts. However, procurement can deliver larger benefits by creating solicitations and contracts that leverage the purchasing power of the enterprise.

How? In short, by deploying it’s experience and expertise across six critical capabilities.

Defining consistent buyer/supplier business processes across business units, such as invoicing, change order, and shop drawing review processes

Defining consistent terms and conditions across business units

Elevating supply market research and analysis

Analyzing CAPEX data to identify enterprise-wide contracting opportunities

Building broad approved supplier lists

Creating and managing the supplier performance evaluation process

Figure 2 (below) shows how these six procurement capabilities form the bedrock upon which a more effective CAPEX procurement process is built.

Action Items Below: After each competency described below, there is an action item. Each action item describes an exercise to help build the competency. The descriptions are directed to the officer overseeing CAPEX procurement and the Chief Procurement Officer (CPO), as they are the individuals who would lead these exercises.

1. Defining Consistent Buyer/Supplier Business Processes Across Business Units

When suppliers are accustomed to incurring costs from dealing with differences in how an enterprise’s business units choose to operate, these costs are reflected in the prices the business units pay. Some examples of business processes that may vary from one business unit or plant to another are shown in Figure 3. The challenge for the procurement organization is to get business units to interact with suppliers in consistent ways, which will ultimately lower the suppliers’ costs and pricing.

To minimize these variations, the procurement team should work with each business unit, seeking common processes where practical, and drafting solicitation and contract language that reflects the new ways of working.

This enables the procurement team to present the enterprise to suppliers as a unified, power purchaser and gives the suppliers comfort in knowing they have a limited number of ways that they are required to interact with the business units. The more uniformity that the procurement organization can drive in supplier–buyer processes, the easier the buyer is to serve, which ultimately results in tangible and intangible benefits to the enterprise.

Action Item: Develop a process comparison table that captures text from recent contracts for each business unit that describes how each of the above processes works for that contract. Compare the descriptions, looking for common elements to build a single clause for each. Meet with representatives from each business unit to review the new clauses. Continue refining these clauses with input from the business units with the intent of keeping only essential variations.

Case Study

PROJECT:

Power plant pollution-control device

COST:

$230 million

SCHEDULE:

EPA rule required fast-track construction

Plant engineering and the production business unit signed an engineer/construction manager contract with little involvement from procurement.

The A/E firm proceeded with design work and drafting of specifications. Using its boilerplate, combined with the plant owner's boilerplate, the A/E firm issued RFPs.

Suppliers did not respond because of inconsistencies in process, terms and conditions, and performance requirements. Further, the A/E issued the solicitations only to it's preferred suppliers against the policies of the plant owner.

To correct this problem, the plant owner's CPO hired Blue Burro to assume procurement responsibilities for this project and work with the A/E firm and the supply market.

To start, Blue Burro adopted the terms and conditions of the plant owner and worked with the A/E firm to provide technical specifications only. Leading a joint team of the plant and project managers with the A/E team, and supplemented with market research, the group created a cohesive contracting strategy and expanded the list of suppliers to receive RFPs.

Within four months, 40 contracts were completed, negotiated, and awarded. Despite the initial lost time, the project finished on-time, under budget, and plant emissions met the new EPA requirements. Further, the use of a consistent supplier performance evaluation process across all suppliers drove top-tier performance from most suppliers and expanded the plant-owner's approved supplier list for future work.

2. Defining Consistent Terms and Conditions Across Business Units

Achieving consistency across business units when it comes to terms and conditions can be equally as challenging as changing business unit processes to provide a consistent interface to the supplier community. However, common terms and conditions are important for providing a consistent risk profile across the enterprise. Procurement should work with in-house counsel and each business unit to drive to a common, approved set of templates. The key terms of CAPEX-related contracts that typically receive the most attention are as follows:

Warranty

Limitation of Liability

Remedies

Indemnities

Insurances

Bonding

Force Majeure

Termination

Delay and Extension of Time

Liquidated Damages

Acceptance and Testing

Consistency across these terms, combined with consistent supplier/buyer interface processes, not only makes the enterprise easier to deal with from the supplier’s point of view, it also simplifies and standardizes internal processes, eliminating unnecessary plant-to-plant variations.

Action Item: Develop a T&C comparison table for the terms listed above, capturing the text from recent contracts for the purchase of comparable items (e.g. engineered equipment) from each business unit. Compare the terms, looking for common elements to build a single clause for each. Meet with management and counsel of each business unit to review the new clauses and identify elements that must be modified. Continue refining these clauses with input from the business units to form the basis for an enterprise-wide set of contract templates.

3. Elevating Supply Market Research and Analysis

It is common to hear the phrase, “sourcing is all about numbers.”

However, it is not as common to see extensive supply market research and analysis being used to provide numbers.

Market research and analysis provides a key piece of knowledge supporting contracting and solicitation strategies and building approved supplier lists. The skills of good researchers include a technical understanding of the products and services, strong business analysis skills and a keen interest in building scenarios of where and how fast supply markets are going. (Plant engineers going to executive MBA programs are good candidates for such positions on the procurement team.)

Action Item: Spend two hours per week with your CAPEX buyers training them on techniques to analyze supply markets. Such research and analysis can include defining the supply market, listing and counting the number of suppliers, charting changes in the number of suppliers over time, growth rate of the market in revenues, and market share concentration calculations, such as the Herfindahl-Hirschman Index (HHI). Adjust the nature of the analysis to the research and math skills of the group. Have each buyer research the markets from which they regularly buy. Note which CAPEX buyers gravitate to and enjoy this type of analysis.

4. Analyzing CAPEX Data to Identify Enterprise-wide Contracting Opportunities

For your team to find innovative ways to add value to CAPEX procurement, it must have visibility across the enterprise to see forecasted expenditures of business units in detail. It can use this data to mine for enterprise-wide contracting opportunities, looking beyond common-item consolidated purchases and evaluating broader scope, longer-term contracting relationships.

In addition, this data must be timely to be actionable and frequently refreshed to enable your team to devise and implement contracting strategies. (Typical sources for this data include CAPEX budgeting and approval systems, annual business unit budgets, and business unit- and plant-level spreadsheets. In nearly all cases, the data contained in corporate systems must be supplemented with more details by the persons working the project.)

Having timely CAPEX forecasts is key. At the same time, your procurement team must analyze the data in a manner that surfaces contracting and solicitation strategies which produce better results than one-time buys. The procurement team must leverage its knowledge of supply markets to find ways to combine various purchases into broader scope contracts.

When making CAPEX purchases, the key functions that the enterprise must align are design/engineering, manufacturing/fabrication and installation/construction. (Figure 4 shows four ways these functions can be combined.)

Figure 4. Scope Options for CAPEX Purchases

In the first option, the three functions are treated separately. Not all must be performed under contract. For organizations with adequate engineering staff, the engineering may be done in-house. Likewise, for those organizations with adequate craft labor resources, installation may be performed in-house.

In option 2, an engineer or a manufacturer is the prime contractor and is responsible for the engineering and manufacturing of the equipment, with in-house labor or contractors performing the installation.

In option 3, a manufacturer or installer is prime and responsible for providing the equipment and installation per specifications developed by in-house or contract engineers.

Option 4 includes the broadest scope where one supplier provides a complete solution; installed, tested, and ready to operate.

For projects where architects are the primary designers, the contracts would generally be design-build and where engineers are the primary designers, the contracts would generally be engineer, procure, construct (EPC) contracts that often include extensive performance standards and testing procedures.

In CAPEX projects, there are variations to these four options that include further allocating roles and risks (such as engineering, procurement, construction management (EPCM) contracts and EPCM/EPC hybrids). Further, some public projects involve operating the new assets, sometime for decades in a public-private partnership, 3P, arrangement.

The most appropriate strategy is the one that achieves the targeted cost, schedule, and quality requirements for the project. (Note: For some projects, the additional requirement to make the project “bankable” becomes a significant factor in strategy selection.)

Each of these options achieves the end result of a new piece of equipment, new facility or other capital item being made ready for operation. Choosing the best option for any one CAPEX purchase is a challenge. Finding ways to effectively leverage this across multiple CAPEX procurements requires melding analyses of forecasts with understanding of how the supply market works, including verifying approaches through discussions with prospective suppliers.

Action Item: Facilitate a meeting of CAPEX buyers where each is instructed to bring all of the forecast data they can find associated with their CAPEX purchases. Have each list the individuals who originate the data, the systems in which the data is maintained and the frequency the data is refreshed. Conduct a group discussion regarding better ways to manage enterprise-wide CAPEX forecasts.

5. Building Broad Approved Supplier Lists

Too often, business units use legend and lore to compile approved supplier lists, rather than using disciplined evaluations and market research. Where procurement brings together multiple business units for a single buy, it is not uncommon for one business unit’s preferred supplier to be another business unit’s problem supplier. Using the existing lists from each business unit, supplemented with the procurement team’s own market research, should produce a comprehensive list of suppliers. Your team can then undertake progressively more rigorous levels of analysis to determine which suppliers to invite to the table.

Action Item: Have CAPEX buyers pick an upcoming purchase and conduct market research to build a full listing of suppliers that can sell into the geographic regions of the enterprise. Circulate the list to the business units that are planning a purchase for their input. Compile a list of objections to any suppliers on the list and conduct root cause analysis to determine the reason and validity of the objection. Bring the data to the business unit making the objection and jointly work through the data to determine if the supplier should be on the approved supplier list.

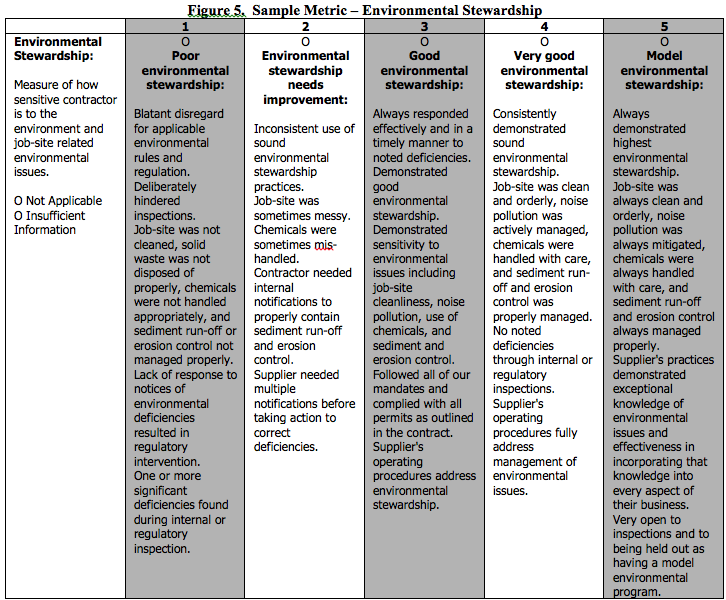

6. Creating and Managing the Supplier Performance Evaluation Process

Creating meaningful performance evaluations for CAPEX suppliers is often more challenging than for raw material or MRO suppliers.

The metrics that are most important are not measured through normal data captured as are, say, on-time deliveries or number of stockouts. Rather, a defined set of scorecards should be created that allows stakeholders to quantitatively score suppliers based on descriptive metrics.

For example, Figures 4 and 5 provide specific attributes used to define levels of performance and minimize subjectivity. The supplier performance evaluation process and scorecards should be made part of the contract, helping to further clarify performance expectations.

Action Item: Facilitate a 90-minute meeting of selected business unit and plant managers with the purpose of defining a set of metrics for one type of CAPEX purchase, such as on-site construction. Keeping within the time limit of the meeting, attempt to reach consensus on the list of metrics. As time permits, work through the list to gain consensus on the wording for the attributes that describe the performance levels. Use “1” as poor performance and “5 as exceptional performance.

Conclusion

To realize significant savings from enterprise-wide CAPEX purchasing, the procurement organization must take the lead in building specific CAPEX procurement capabilities within the enterprise and across business units and plants.

These capabilities include six items focused on process and contractual consistency, analysis of supply markets and spend forecasts, and effective supplier management.

Defining consistent supplier/buyer business processes across business units, such as invoicing, change order, and shop drawing review processes

Defining consistent terms and conditions across business units

Elevating supply market research and analysis

Analyzing CAPEX data to identify enterprise-wide contracting opportunities

Building broad approved supplier lists

Creating and managing the supplier performance evaluation process

With these capabilities in place and fully engaged, procurement teams can realize savings of 25 percent or more on CAPEX purchasing. As always, change involves risk and although there is much published guidance on change management, each company must assess the best way to implement these changes.

In most organizations, change is necessary to realize the competitive advantage of enterprise-wide CAPEX purchasing.